Your Credit History

Your Credit History

Once you begin to use credit, you establish a credit history. A credit history is a record of whether or not you have repaid debts on time and according to signed agreements. This record also includes a list of everyone who has accessed your report for up to two years. These are called “inquiries.” The agency that maintains credit records is called a credit bureau. When you apply for credit, a credit grantor looks at your credit history to determine if you are a good credit risk. You can see why it is important to have a credit history that shows you have paid your debts on time.

If you’ve never had credit, you probably have no credit history. Not having any credit history is not a good thing. With no credit you can have higher interest rates, until you have proven yourself creditworthy. Take these steps to establish credit for the first time:

- Maintain steady employment.

- Open a checking and savings account, and use them responsibly.

- Apply for a gas or department store credit card, and make prompt payments.

- Ask a relative or friend who already has a good credit history to co-sign a small loan. Pay the loan back promptly.

Your Credit Report

If you’ve been turned down for credit within the last 60 days, you are entitled to receive a free copy of your credit report from the credit reporting agency that supplied information about you. These are the three major credit reporting agencies: Even if you have not been denied credit, it is a good idea to check your credit report at least once a year to make sure everything is correct and you are not a victim of identity theft. Identity theft, where someone else uses your name or credit unlawfully, is becoming more and more common. Although credit reports generally cost around $10, a new law went into effect in 2005 giving you the right to get one free copy of your credit report from each of the three credit bureaus each year by following these instructions:

To order your FREE CREDIT REPORT, visit www.annualcreditreport.com to apply online or print a form to order your free credit report by mail. You may also order by calling 877-322-8228.

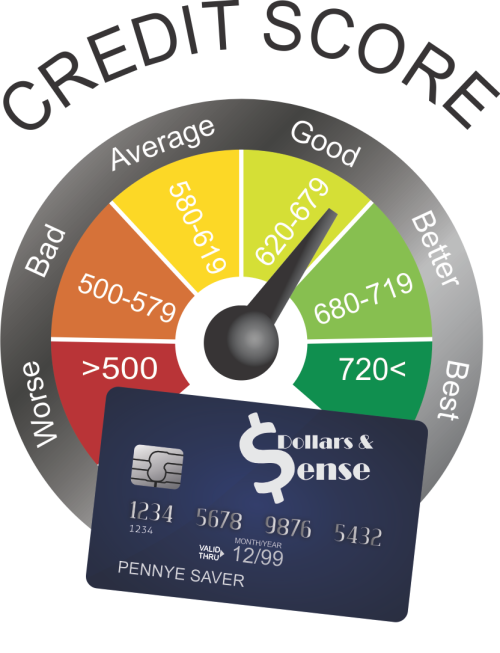

Free credit reports are available only from the annualcreditreport.com web site. If you order directly from a credit bureau, you may be charged. There is no provision to receive a free credit score. Credit scores are available, but there is a fee. Next week, credit scoring will be reviewed.