Is credit a tool or a trap? Is it a friend or foe? Depending on your financial situation you may see that it is both or neither one. However, when used wisely, credit is truly a tool to aid the ‘average’ American to acquire the items in life that we need for security, stability and comfort. However, let’s not forget that credit costs money. Finance charges, including interest payments, annual fees, late payment fees and over-the-limit fees, can add up quickly. Failure to realize the TOTAL cost of credit can lead to debt overload.

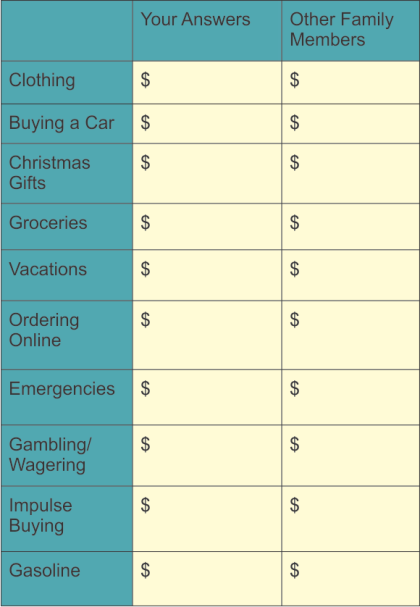

Remember, when you use credit, you are spending future income, how will you replace that income already spent? Since bills don’t arrive for a month, it’s tempting to overspend. Families should discuss the use of credit and how to use it to their advantage. The chart below can help you talk about how credit should be managed.

Consider this hypothetical example: You buy a $2,000 flat screen TV on a credit card with 15% interest rate; making only the minimum monthly payment, it would take more than 17 years to pay off the original debt. The credit card company pay off amount would be more than $2500 in interest – doubling the cost of the TV. Wow!

Next Page